“Kakao’s acquisition of SM is handing over K-pop to the Chinese capital.”

Kakao suddenly disclosed the details of its shareholder structure. Controversy over Chinese funds surrounding Kakao’s SM stake investment is spreading online, and it is aimed at dispelling it.

It can be interpreted as a conscious response to the criticism of some that “If you hand over shares of SM Entertainment to Kakao, you are handing over K-pop to the Chinese capital.” The industry believes that Kakao, competing with Hive for SM, has made an unusual disclosure of the shareholder composition to emphasize that it is a ‘national stock’ rather than a Chinese capital.

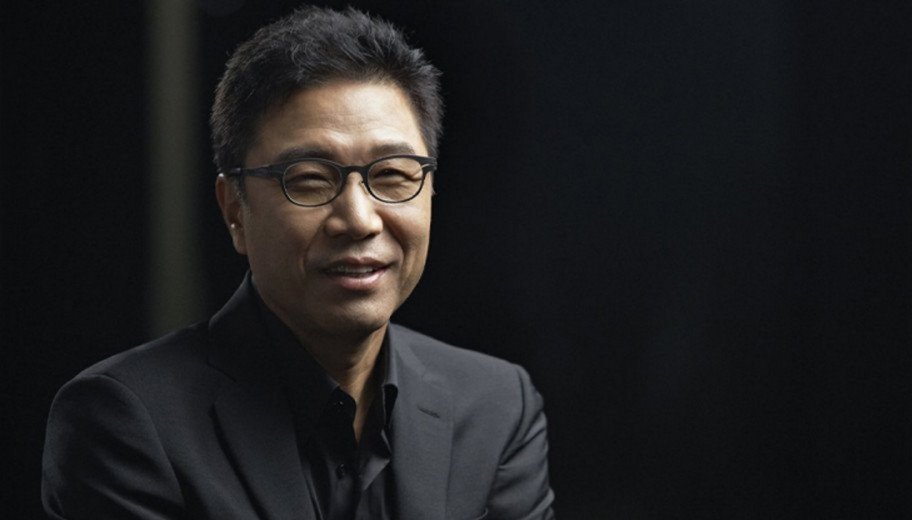

In fact, according to the information disclosed by Kakao, the proportion of domestic investors is overwhelming at 73.9%. As of the end of last year, Kakao’s significant shareholders were founder Kim Bum-soo (13.3%) and his family company K Cube Holdings (10.5%), National Pension Service (6.1%), as well as Tencent’s subsidiary Maximo (5.9%) and SK Telecom (2.4%). ), the Singapore government (1.1%), and the Norwegian central bank (1%). Looking at the shareholder distribution by country, domestic is 73.9%, Singapore is 7.3%, North American 7.2%, and other foreigners 11.6%.

Nevertheless, Kakao’s ‘Chinese capital’ tag still follows. The fact that Kakao Bank and Kakao Pay attracted investments from Chinese subsidiaries of Tencent and Ant Group, respectively, contributed to this misperception.

While Chairman Bang Shi-hyuk and former SM executive producer Lee Soo-man joined hands, SM’s current management and Kakao confronted each other with omnidirectional cooperation. The ‘enter war’ between the two sides escalates into an extreme confrontation. In particular, SM management fiercely attacks former producer Lee Soo-man, saying he made considerable money inside and outside the company. Some even put a Chinese frame on Kakao, trying to form an ‘anti-Kakao’ camp.

Kakao was counterattacked by Hive three days after announcing that it would purchase a 9.05% stake in SM through a paid-in capital increase and become the second largest shareholder. Earlier, Hive secured a 14.8% stake (428.1 billion won) from former SM general producer Lee Soo-man, becoming the number one shareholder in SM.

Kakao Entertainment also received 897.5 billion won, part of the large-scale investment attracted by Saudi Arabia’s sovereign wealth fund. Attention is focusing on whether Kakao founder Kim Bum-soo (head of the Future Initiative Center), caught off guard by Chairman Bang Jun-hook of Hive over SM management rights, will invest a large amount of money to buy stocks.

Hive plans to secure an additional 25% stake in SM by the 1st of next month through a public purchase of SM shares at 120,000 won per share. However, SM’s share price has exceeded 120,000 won, and it is having difficulties with a tender offer. Based on the closing price on the 24th, SM’s share price was recorded at 121,000 won. Some predict that the market situation may change if Kakao, which has secured an advantage in financial power, raises the tender offer price and starts a counterattack.

However, the variable results from the application for an injunction to prohibit the issuance of new shares and convertible bonds (CB) filed by former general manager Lee Soo-man against SM to prevent Kakao from securing claims. Kakao’s intention to participate in the SM takeover battle will become clear depending on the results. Hive’s tender offer deadline is March 1st, and Kakao’s payment date for SM’s new shares issuance is March 6th.